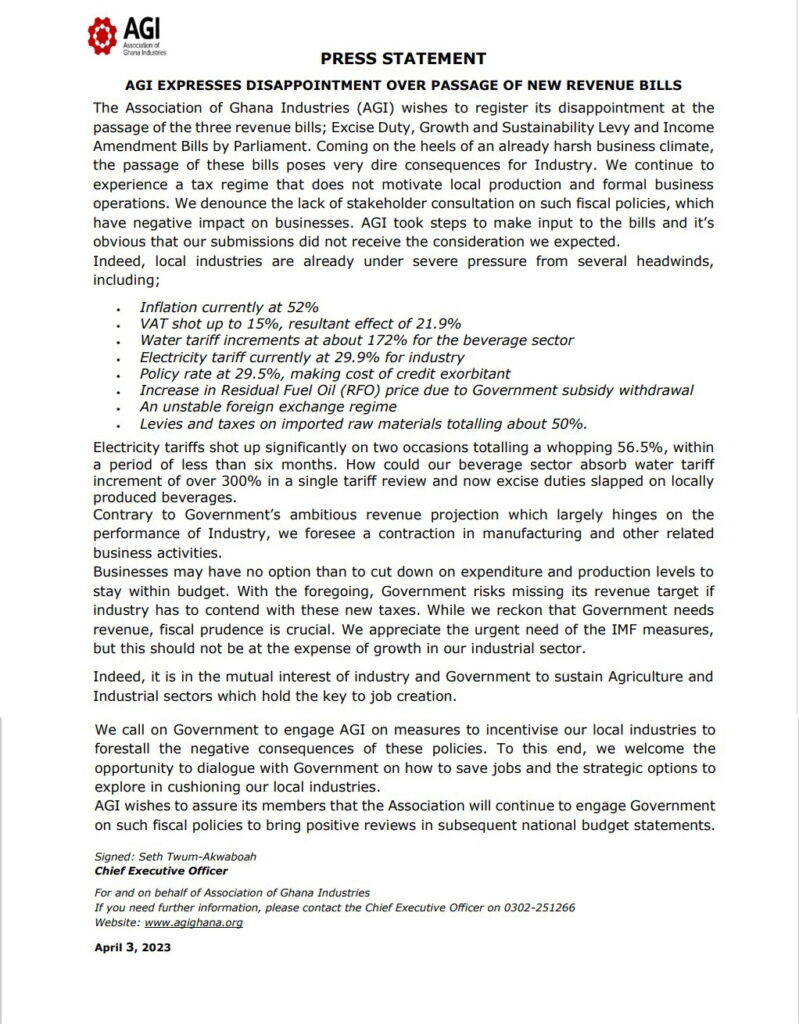

The Association of Ghana Industries (AGI) has stated that the group is disappointed by the passage of the new tax bills by the government.

Three new revenue bills were passed by parliament on Friday, 31st March, 2023. These bills include the Excise Duty, Growth and Sustainability Levy and the Income Amendment Bill.

According to AGI, “the passage of these bills will pose very dire consequences for the industry considering the already harsh business climate.’’

In a statement issued by AGI on Monday, 3rd April 2023, it was stated that the country continues to experience a tax regime which doesn’t support local production and formal business operations.

The statement sighted by 1Family Radio noted, “we denounce the lack of stakeholders consultation on such fiscal policies, which have negative impact on businesses. AGI took steps to make input to the bills and it’s obvious that our submissions did not receive the consideration we expected.’’

It furthered hinted that local businesses are already suffering from high “inflation rate at 52%, VAT shot up to 15%, resultant effect of 21. 9%, levies and taxes on imported raw materials totaling to 50%, water tarrif increments at about 172% for the beverage sector, electricity tarrif at 29.9% for industry and policy rate at 29.5%, making cost of credit exorbitant.’’

The statement which was signed by the Chief Executive Officer of the Association, Seth Twum-Akwaboah projected that it will be in the mutual interest of both the industry and the government if the agriculture sector and the industrial sectors are sustained.

AGI has appealed to the government to engage the association on measures to incentivize the local industries to forestall the negative implications of these policies.

Source: 1Familyradio